We provide all-round support to Polish and foreign entrepreneurs in developing their businesses at both a domestic and international scale.

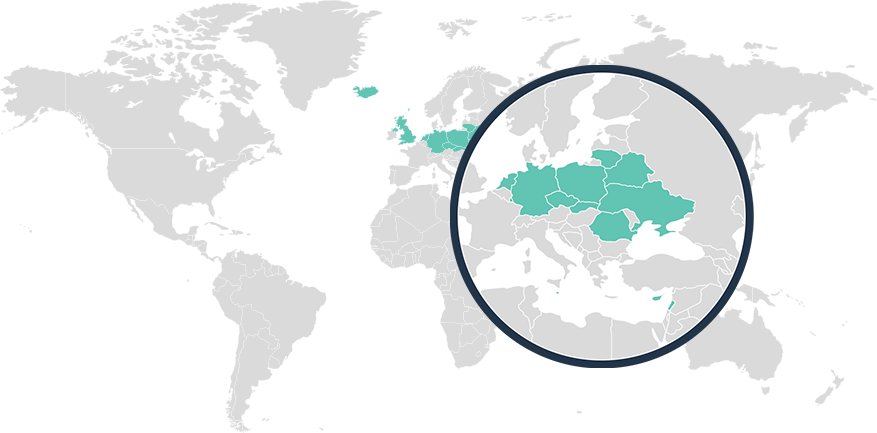

We help entrepreneurs develop their businesses through end-to-end support – starting with reg-istration, followed by tax & legal assistance and auditing services concerning day-to-day opera-tions, to introduction to foreign markets. We are present in 18 countries, adapting our solutions to the needs of every client in line with the one-stop-shop model.

We provide assistance to every industry, having many years of experience from work with corporate cli-ents from the key sectors of the economy.

We provide consultancy to both the SME sector and international corporations as well as offer an array of property management services for private individuals.

Both the presentation and the materials we received confirmed our belief that entrusting our employees into your hands was the right choice. Professionalism and diligence are the two words that perfectly describe the ECDP experts. This is the kind of partner that value the most.

The training provided by ECDP Szkolenia is highly recommendable, in particular to companies which want to boost their efficiency by improving the skills of their staff.

We recommend ECDP as a professional partner providing comprehensive tax consultancy services. Their experts are a guarantee of professionalism, completing every task in a timely and careful manner. It is with utmost confidence that we recommend ECDDP as a competent, reliable and responsible partner.

The day-to-day tax consultancy provided by ECDP for our company include in particular the preparation of opinions on tax law issues and the analysis of aspects of business ventures.

Our cooperation with the ECDP team is always to the highest professional standard. DB Cargo Polska S.A. recommends their services.

The ECDP experts are guarantee of a versatile, top-quality service. Our long, seamless cooperation provides a solid reason for us to recommend ECDP as a trustworthy and professional partner.